Unlocking Wealth: Endowment Policies Investment – A Costly Mistake

Pune, 16 March 2024: Endowment plans, commonly known as policy investments, promise to serve as both insurance and investment schemes, but they fall short on both fronts. Despite catchy names like “Life Sanchay”, “Sampoorn Samriddhi”, “Fortune Guarantee”, “Jeevan Anand” etc., they typically offer low returns of just 2-6%, coupled with complex terms and conditions, which is less than what you could earn with a fixed deposit. Moreover, the insurance coverage they provide isn’t adequate to support your family when they truly need it. So, while they may sound appealing, they’re not the wise choice for growing your money or safeguarding your loved ones.

Then the question arises: why do people invest in endowment policies? The problem lies in people’s lack of understanding regarding the investment and returns associated with these policies. Complex documents further exacerbate the issue, making it difficult for individuals to decipher the details. Additionally, the familiarity of insurance agents—often neighbors, friends, or relatives—makes it challenging to resist their persuasion, leading to impulsive purchases of endowment policies. These agents often receive substantial commissions, sometimes up to 50% of the policy’s premium, which incentivizes them to vigorously promote these policies. For instance, if you invest ₹1 lakh per month (₹12 lakhs per year), your agent pockets ₹6 lakhs as a commission in the first year alone.

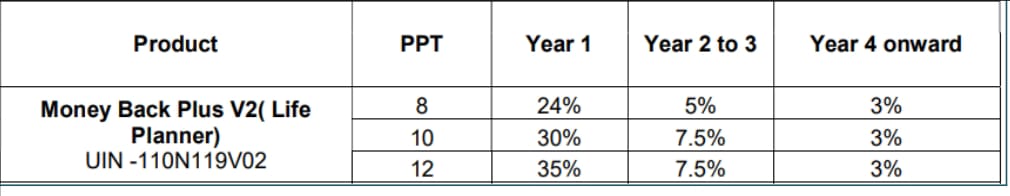

Consider this example of the commission structure for a Tata AIA endowment policy: if the policy’s paying term is 12 years, agents receive a hefty 35% commission on the policy premium paid by the investor for the first year alone.

This is just one example and not meant to single out any specific company. Many insurance companies, including LIC, HDFC, and ICICI etc., offer endowment plans that often result in people losing their hard-earned money. To promote these plans, agents receive substantial commissions, encouraging them to aggressively market these products.

When should you surrender an endowment policy? Ideally, you would never have entered into one. But if you find yourself in that predicament, it’s generally wise to cut your losses and surrender it as soon as possible. However, here’s the tricky part: if you surrender your policy after paying premiums for the first year (let’s say you’ve paid 1 lakh per month, totaling 12 lakhs in a year), you’ll be shocked to find out that in most endowment plans, the surrender value is zero. Yes, all 12 lakhs are gone. Then, they’ll insist you continue for another year, requiring another 12 lakhs in premiums. After two years and a total outlay of 24 lakhs, you’ll only get back 30% of what you paid—just 7.2 lakhs. Continuing into the second year only deepens the loss. And if you consider the concept of the time value of money, the loss compounds further in subsequent years.

It’s baffling why regulatory bodies permit such exploitation through endowment plans. One can only hope they’ll implement stringent regulations to protect vulnerable investors from this financial predation.

Endowment Policies Vs Mutual Fund Investments: Consider this scenario: if you invest 1 lakh per month for 15 years in a mutual fund, assuming a 12% return, you would accumulate 5 crores by the end of the 15th year. In contrast, if you opt for an endowment plan with the same monthly premium for 15 years, but as you will get only around a 5% return, you’d only receive around 2.7 crores at the end of 15 years. Clearly, investing in mutual funds could yield approximately double the returns with more liquidity compared to an endowment policy.

Endowment plans fail to provide adequate insurance coverage or satisfactory returns, making it unwise to combine insurance with investment. Instead, opt for separate term insurance, obtained through nominal premiums, and invest your funds in products offering superior returns and greater liquidity. This approach ensures a more effective strategy for securing your financial future.

About the Author:

Hradayesh Pathak holds an MBA in Finance from XLRI Jamshedpur and has successfully passed CFA Level 2.