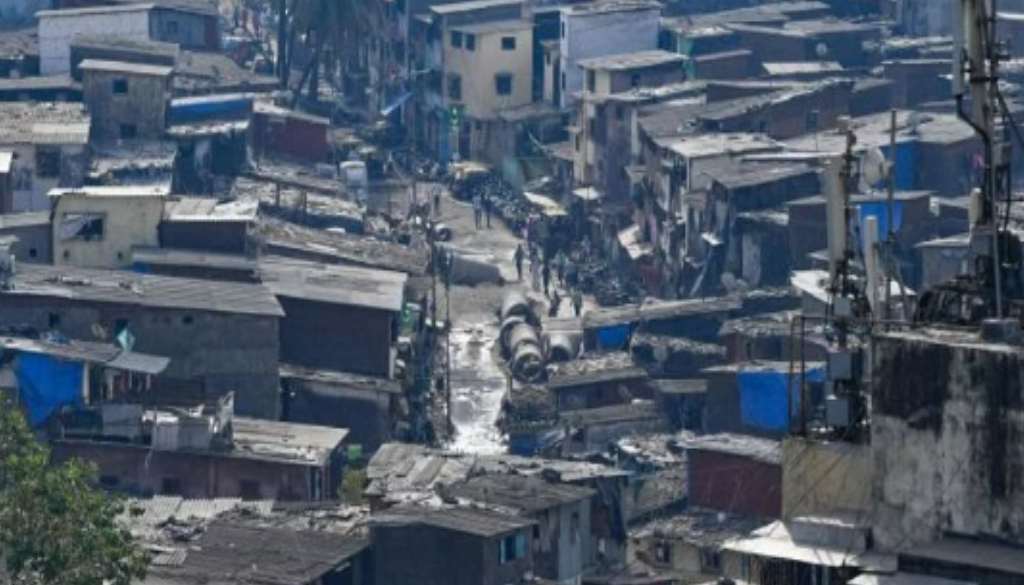

Mumbai: Dharavi Project Sparks Fears: Proposed TDR Changes May Escalate Suburban Redevelopment Expenses

Mmbai, 22nd November 2023: Concerns have emerged regarding the potentially high cost of redevelopment in the suburbs due to proposed changes in the use of Transferable Development Rights (TDR) without indexation. In the SRA’s Dharavi Redevelopment Project, it is suggested that TDR should be generated at 90 per cent of the ready reckoner, leading to fears of increased expenses for redevelopment projects in the suburbs. Experts in the field argue that if TDR were made available according to the existing policy, it could have controlled TDR rates by fostering competition.

The Dharavi Redevelopment Project, spearheaded by a special purpose company of the Adani Group, with the Maharashtra state government holding 20 per cent and the Adani Group owning 80 per cent, has received various concessions to enhance its viability. However, concerns arise as TDR rates are expected to rise by almost 40 per cent in redevelopment, with a fixed rate of 90 per cent of the ready reckoner. Currently, TDR is available in the market at rates ranging from 30 to 40 per cent. With the increased rate of TDR in Dharavi, there is a fear that these elevated rates will persist until Dharavi’s TDR becomes available.

Under the current policy, indexation is applicable wherever TDR is allowed to be used. This means that the TDR available in the suburbs would not be at the same rate as the ready reckoner in the city or other strategic locations. The demand for TDR is highest in the suburbs, and TDR is generally not required in Mhada or slum rehabilitation projects but is crucial in the redevelopment of private buildings.

Developers express concerns that when Dharavi’s TDR becomes available at a 40 per cent rate, other TDRs will also need to be purchased at the rate set for Dharavi. Currently, stakeholders have a one-month window to submit objections and suggestions regarding the proposed changes.